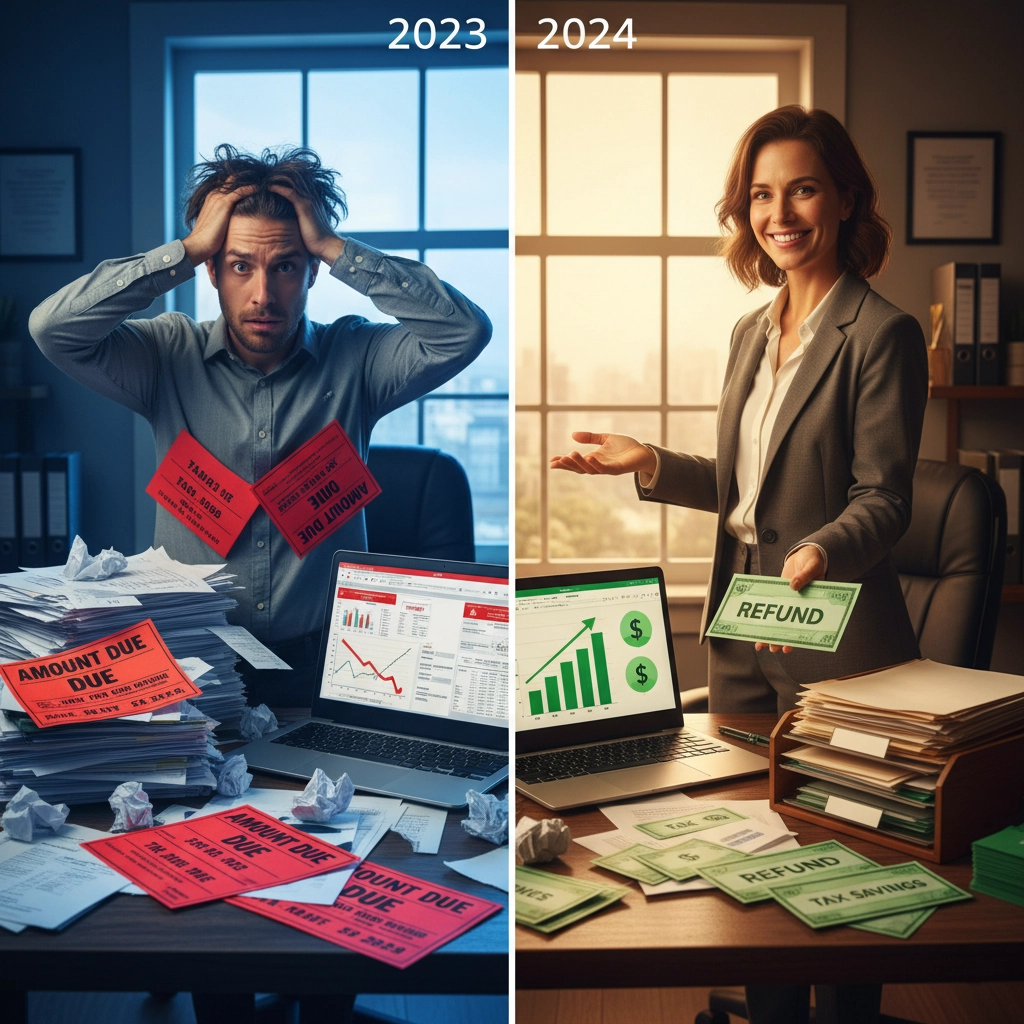

Nobody likes handing over more money to the IRS than they legally have to. Yet millions of Americans do exactly that every single year, simply because they don’t know the strategies that could keep thousands of dollars in their own pockets instead of Uncle Sam’s.

That’s where MWR’s professional tax team comes in. Our tax reduction specialists have helped members slash their tax bills by an average of $8,000 to $15,000 annually: and that’s just the beginning. With 2025 bringing new opportunities and updated tax brackets, now’s the perfect time to get serious about keeping more of what you earn.

How MWR’s Tax Pros Work Differently

Most people think tax preparation happens once a year during “tax season.” That’s backwards thinking that costs you money. MWR’s approach starts with year-round strategic planning that positions you to minimize taxes before they’re even calculated.

Our certified tax professionals don’t just fill out forms: they architect comprehensive tax reduction strategies tailored to your specific financial situation. Whether you’re a high-income earner, business owner, investor, or working professional, we’ve got proven methods to legally reduce your tax burden.

The difference lies in proactive planning versus reactive filing. While most tax preparers look backward at what already happened, MWR’s team looks forward to structure your finances in ways that minimize future tax obligations.

Core Strategies That Deliver Real Results

Strategic Retirement Contributions form the foundation of most successful tax reduction plans. Our team helps you maximize contributions to 401(k)s, IRAs, Solo 401(k)s, and other tax-advantaged accounts. For 2025, the contribution limits have increased, creating even bigger opportunities to reduce current taxable income while building long-term wealth.

But here’s where MWR goes deeper than basic advice: we help you choose between traditional and Roth contributions based on your current tax bracket, future income projections, and overall wealth-building strategy. Sometimes paying taxes now saves you tens of thousands later: and sometimes deferring is the smarter play.

Business Structure Optimization can be a game-changer for entrepreneurs and side-hustle owners. Many people leave money on the table by operating as sole proprietors when incorporating as an S-Corp or LLC could save thousands in self-employment taxes alone.

Our tax pros analyze your situation and recommend the optimal business structure, then help you implement strategies like:

- Home office deductions that actually pass IRS scrutiny

- Vehicle expense optimization (it’s not just mileage anymore)

- Equipment purchases timed for maximum tax benefit

- Strategic expense timing to manage taxable income

Investment Tax Management becomes crucial as your wealth grows. Tax-loss harvesting, strategic asset location, and timing of capital gains can dramatically impact your overall tax bill. MWR’s team coordinates with your investment strategy to ensure you’re not accidentally triggering unnecessary tax events.

The MWR Guarantee That Changes Everything

Here’s what sets MWR apart from every other tax service: we guarantee our work will find you tax savings equal to at least your membership investment, or we’ll refund your membership fee. Period.

This isn’t some fine-print guarantee with impossible conditions. It’s a straightforward promise backed by our track record of consistently finding substantial tax savings for members across all income levels and situations.

Why can we make this guarantee? Because most people are missing dozens of legitimate deductions and strategies they’ve never heard of. Our systematic approach to tax reduction uncovers opportunities that typical tax preparation misses completely.

Advanced Strategies for Wealth Builders

Charitable Tax Strategies go way beyond writing a check to your favorite charity. MWR’s team helps you implement sophisticated approaches like:

- Donating appreciated securities to avoid capital gains while claiming full deduction

- Establishing donor-advised funds for maximum flexibility and tax benefit

- “Bunching” charitable donations to exceed standard deduction thresholds

Estate Planning Integration ensures your tax reduction strategies align with your long-term wealth preservation goals. Our tax pros work alongside estate planning attorneys to implement strategies that reduce current taxes while protecting future generations from excessive estate taxes.

Real Estate Investment Strategies unlock some of the most powerful tax advantages available. From depreciation schedules that create paper losses offsetting other income, to 1031 exchanges that defer capital gains indefinitely, real estate offers unique tax benefits when structured properly.

How Our Pro Team Process Works

Getting started with MWR’s tax professionals is straightforward. First, you’ll complete a comprehensive financial assessment that goes far beyond basic income and expenses. We analyze your complete financial picture to identify every possible tax reduction opportunity.

Next, our certified professionals develop your personalized tax reduction strategy. This isn’t generic advice: it’s a specific roadmap designed for your exact situation, goals, and timeline.

Throughout the year, you’ll receive ongoing guidance and updates. Tax laws change, life circumstances shift, and new opportunities emerge. Our team keeps you informed and helps you adjust your strategy to maintain maximum tax efficiency.

When tax season arrives, preparation becomes simple because the groundwork was laid months earlier. No scrambling for documents or missing deadlines: just smooth execution of your pre-planned strategy.

Real Member Success Stories

Sarah, a marketing consultant from Texas, was paying over $12,000 annually in self-employment taxes alone. After working with MWR’s tax team to restructure her business as an S-Corp and implement strategic deductions, she cut her total tax bill by $9,400 in the first year.

Mike and Jennifer, a dual-income couple from Colorado, thought they were doing everything right with their taxes. Our team found $11,200 in additional deductions and credits they’d been missing, plus restructured their investment accounts to reduce future tax obligations by an estimated $3,000 annually.

These aren’t exceptional cases: they’re typical results when professional tax strategies replace do-it-yourself guesswork.

Why Timing Matters More Than Ever

Tax reduction isn’t something you can fix after the fact. The strategies that deliver the biggest savings require planning and implementation throughout the tax year, not during the final weeks of December.

With 2025’s updated tax brackets and changing regulations, the opportunities for tax savings are significant: but only if you act strategically. Waiting until next March to think about taxes means missing most of the year’s optimization opportunities.

The members who achieve the biggest tax savings start their planning early and stay engaged with the process throughout the year. They understand that tax reduction is an ongoing strategy, not a once-annual event.

Ready to Keep More of Your Money?

Every day you delay implementing professional tax strategies is money left on the table. While others hand over thousands in unnecessary taxes, MWR members keep more of what they earn through proven, legal tax reduction methods.

Our tax professionals are ready to analyze your situation and develop your personalized tax reduction strategy. With our guarantee backing every recommendation, you have nothing to lose and thousands to gain.

Don’t let another tax year pass without maximizing your tax savings. Join the thousands of MWR members who’ve discovered how much money they can keep when professional tax strategies replace amateur guesswork.

Ready to slash your tax bill and keep more of your hard-earned money? Visit www.mwrfinancial.com/krnrstn21 today and discover how MWR’s professional tax team can save you thousands starting this year. Your future self will thank you.

Tweet Draft for Sonny: “Stop overpaying taxes! 🏦 MWR’s tax pros help members save $8K-$15K annually through strategic planning that goes beyond basic tax prep. With our guarantee, you have nothing to lose and thousands to gain. Discover your tax reduction strategy → www.mwrfinancial.com/krnrstn21 #TaxSavings #WealthBuilding”

Leave a comment