If money is tight, your credit’s crashed, or your job just isn’t enough, this is your answer.

Look, we get it. You’re juggling bills, watching your credit score tank, and wondering how you’re going to make ends meet this month. Maybe you’ve been scrolling through “get rich quick” schemes or considering another payday loan just to buy groceries. Here’s the thing: you don’t need another band-aid solution that’ll leave you worse off in three months.

Why Most “Quick Fixes” Are Actually Financial Traps

Before we dive into the real solution, let’s talk about why you’re still stuck despite trying everything. Those cash advance apps? They’re charging you $5-15 per transaction and keeping you dependent on your next paycheck. Payday loans? You already know that nightmare, $15 for every $100 borrowed, due in two weeks when you’re even more broke.

Random side hustles like delivery driving or freelance gigs? Sure, you might make $50-200 a week, but you’re trading your time for pennies while your car gets destroyed and your credit stays broken.

Here’s what these “solutions” have in common: they’re designed to keep you running on a hamster wheel. They address symptoms, not the root problem. You need cash? Here’s a loan with brutal terms. Your credit’s bad? Here’s a secured card that barely moves the needle. Want extra income? Here’s a gig that pays minimum wage after expenses.

The real problem isn’t that you need a quick fix: it’s that you need a complete financial transformation.

How MWR Flips the Script with True 3-in-1 Value

This is where MWR membership becomes a game-changer. Instead of solving one problem at a time (and poorly), MWR attacks all three of your biggest money challenges simultaneously:

1. Financial Assistance Without the Credit Drama

Forget traditional lenders who want to run your credit through the mud. MWR connects members to business funding opportunities that don’t require perfect credit. We’re talking about access to $50K+ in funding that you can get approved for even if your personal credit isn’t where it should be.

The difference? This isn’t some sketchy loan shark operation. It’s legitimate business funding that helps you build wealth instead of deeper debt. Members regularly secure funding for their businesses, side ventures, or investment opportunities: all without the typical credit roadblocks.

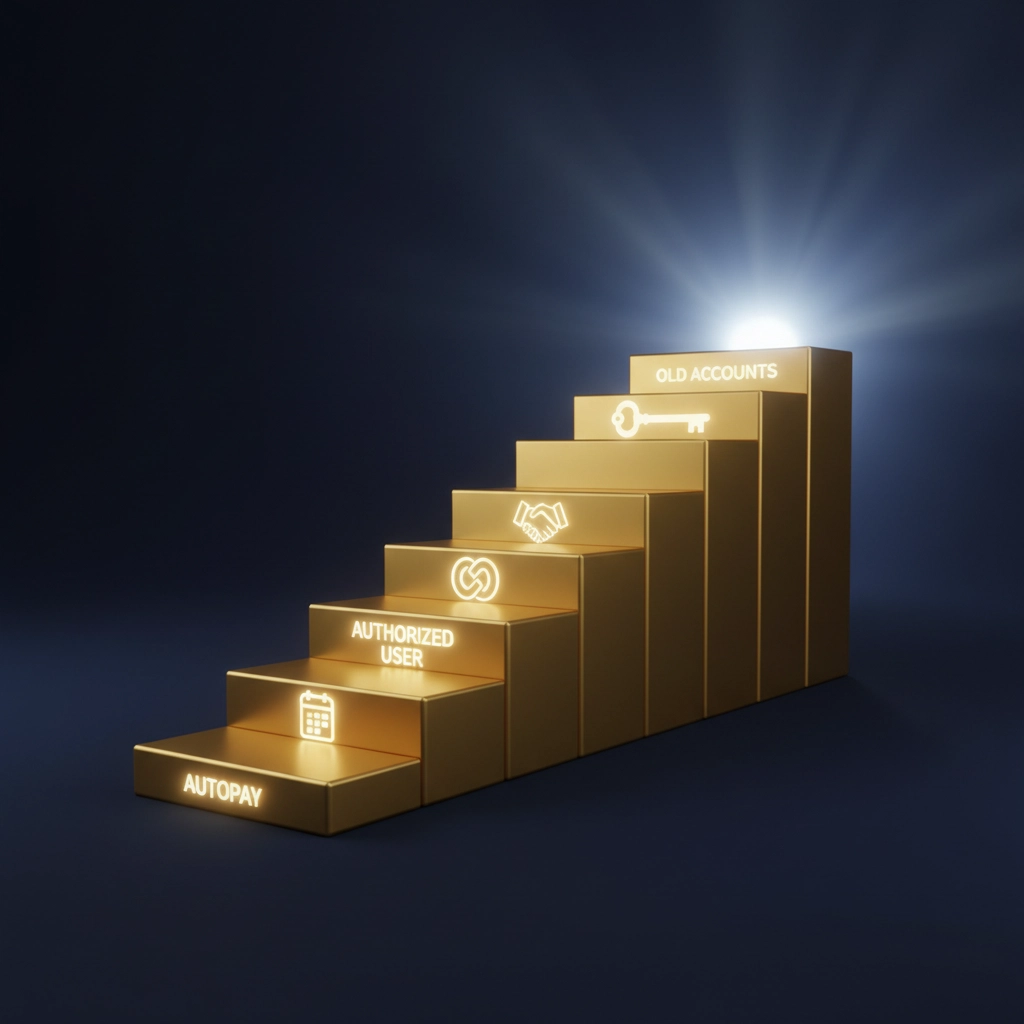

2. Professional Credit Restoration That Actually Works

Here’s where most people mess up: they either ignore their credit or try to fix it themselves with YouTube tutorials. MWR membership includes access to professional credit restoration services that know exactly which disputes to file, when to file them, and how to maximize your score improvements.

But it’s not just about removing negative items. MWR’s approach focuses on building positive credit history while cleaning up the past, creating sustainable credit improvement that sticks.

3. Side Hustle Income with Daily Pay Potential

This isn’t another MLM or “make money posting on social media” scam. MWR members gain access to legitimate income opportunities with daily pay potential through the MWR @Home program. You’re building a real business with real support, real training, and real income potential.

The beauty is in how these three elements work together: The funding gives you capital to invest or start ventures. The credit restoration opens doors that were previously closed. The side hustle creates ongoing income streams. It’s a complete financial ecosystem, not just another product.

Real Talk: What Members Are Actually Achieving

Mark from Detroit was drowning in $40K of credit card debt with a 520 credit score. Three months after joining MWR, he secured $50K in business funding, used part of it strategically to pay down high-interest debt, and started earning $800/week through the MWR @Home opportunity. His credit score is now 680 and climbing.

Lisa in Phoenix was a single mom working two jobs and still couldn’t make rent some months. Within 60 days of her MWR membership, her credit score jumped 100 points, she secured funding for a small business venture, and she’s now earning consistent side income by referring other struggling families to MWR. She quit her second job last month.

Carlos from Miami tried everything: Uber, DoorDash, credit repair companies that took his money and delivered nothing. Six months with MWR? He’s got access to $75K in business lines of credit, his score went from 495 to 720, and he’s earning daily pay through multiple MWR income streams. He’s planning to quit his day job by year-end.

These aren’t cherry-picked success stories. They’re typical results when someone commits to the full MWR system instead of looking for quick fixes.

FAQ: “Is This Real? Will I Actually Get Help with Money and Credit?”

Q: How soon can I access funding after joining? A: Most members begin the funding process within their first week. Approval times vary based on your specific situation, but many members secure initial funding within 30 days.

Q: What if my credit is really, really bad: like 400s bad? A: That’s exactly who this program is designed for. MWR’s credit restoration process has helped members with scores in the 300s and 400s rebuild to 700+. The funding opportunities don’t require perfect credit, so you can start building wealth while your credit improves.

Q: How much can I realistically earn with the side hustle component? A: It depends on your effort and commitment. Some members earn a few hundred extra per month, others build it into a full-time income replacement. The daily pay structure means you see results quickly, which helps maintain motivation.

Q: Is there any upfront cost or hidden fees? A: MWR membership has a monthly fee that covers all three services. No hidden costs, no surprise charges, no separate fees for credit work or funding applications. Everything is transparent upfront.

Q: What kind of support do I get? A: You’re not just buying a membership and being left alone. MWR provides ongoing training, personal support, and a community of members going through the same transformation. Think of it as having a financial mentor and success team in your corner.

The Bottom Line: Stop Choosing Between Solutions

Here’s what’s different about MWR: you don’t have to choose between getting emergency cash, fixing your credit, or starting a side hustle. You don’t have to juggle three different companies, three different monthly payments, or three different timelines.

One membership. Three solutions. Complete financial transformation.

While your friends are still trying to decide between a cash advance app and a credit repair company, you’ll already be building wealth through all three channels. While they’re making minimum payments on maximum debt, you’ll be using professional funding to invest in your future.

The question isn’t whether you can afford MWR membership. The question is: can you afford to keep struggling with the same money problems for another year?

Your financial makeover starts the moment you join. No more choosing between paying bills and building wealth. No more watching your credit score determine your options. No more trading time for pennies.

Why struggle alone when you could have professional support, proven systems, and a community of people rooting for your success? Your future self will thank you for making this decision today.

Tweet Draft for Sonny: “Tired of choosing between fixing credit, getting emergency cash, or starting a side hustle? MWR membership delivers all 3 at once. Real funding, professional credit repair, daily pay opportunities. Stop juggling band-aid solutions. Start your financial transformation: mwrfinancial.com/krnrstn21 #FinancialFreedom”