Your credit report might be the silent assassin destroying your wealth, and you don’t even know it. Every month you carry a balance, miss a payment, or max out a card, you’re literally throwing money away that could be building your future.

Here’s the brutal truth: bad credit doesn’t just mean higher interest rates. It means you’re locked out of wealth-building opportunities that could change your financial future forever.

The Hidden Wealth Killer in Your Wallet

Most people think credit scores only matter when you’re buying a house or car. Dead wrong. Your credit report impacts every aspect of your financial life, from the job you can get to the insurance rates you pay.

When your credit score drops below 650, you’re essentially paying a “poor credit tax” on everything. That mortgage that should cost you 3.5% interest? You’re paying 6% instead. On a $300,000 home, that’s an extra $150,000 over the life of the loan. That’s $150,000 that could have been invested in retirement accounts, rental properties, or business ventures.

But here’s where it gets really ugly: bad credit doesn’t just cost you money, it prevents you from making money. Banks won’t lend you capital for investment properties. Credit card companies won’t give you the limits needed for business purchases. You’re stuck in a cycle where you can’t access the tools wealthy people use to build wealth.

The One Move That Changes Everything

Ready for the game-changer? Here it is: Pay down your credit card balances to under 10% of your available credit limits, tonight.

This isn’t about paying them off completely (though that’s ideal). This is about your credit utilization ratio, and it’s the fastest way to boost your credit score in 30 days or less.

Here’s how it works: Credit utilization accounts for 30% of your credit score. If you have a $5,000 credit limit and you’re carrying a $3,000 balance, you’re using 60% of your available credit. That’s killing your score.

But drop that balance to $500 (10% utilization), and your score can jump 50-100 points within one billing cycle. I’ve seen people go from 580 to 680 in six weeks just by fixing their utilization.

The Emergency Move: If you can’t pay down the balances, call your credit card companies and ask for credit limit increases. Don’t use the extra credit, just let it lower your utilization percentage. Many companies will approve increases instantly over the phone.

Stack These Quick Wins for Maximum Impact

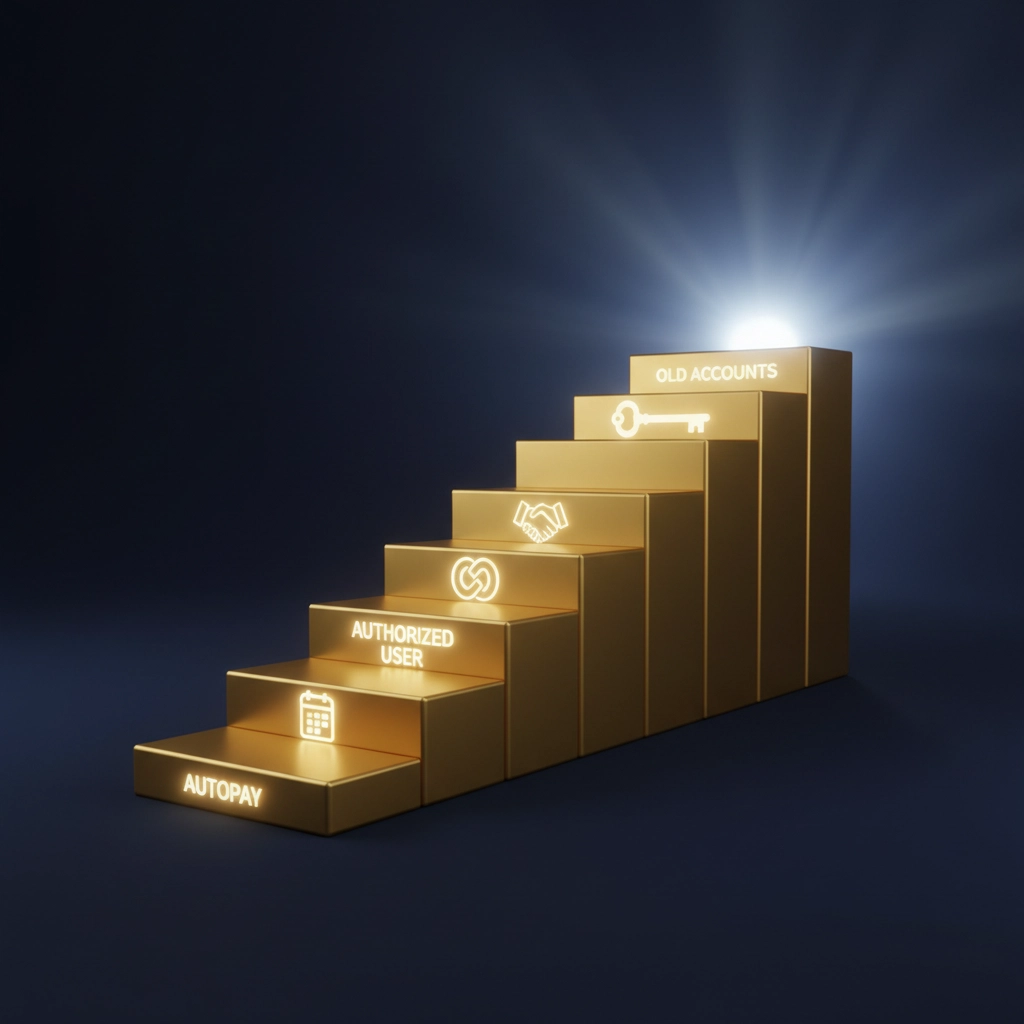

While you’re fixing utilization, hit these other wealth-building credit moves:

Set Up Autopay for Everything: Late payments destroy credit scores faster than anything else. Set up automatic minimum payments for every bill. This single move protects 35% of your credit score calculation.

Become an Authorized User: Find someone with excellent credit (family member, spouse, close friend) and ask to be added as an authorized user on their oldest, highest-limit card. You don’t need the physical card, just being on the account can boost your score in 30 days.

Don’t Close Old Cards: That card you got in college? Keep it open. The length of your credit history matters, and closing old accounts can actually hurt your score.

Why This Matters for Your Wealth

Every 20-point increase in your credit score translates to thousands of dollars in savings and earning potential. Here’s what better credit unlocks:

- Lower mortgage rates = More house for less money or smaller payments

- Business credit lines = Capital to start or expand income streams

- Investment property loans = Access to rental income and appreciation

- Lower insurance premiums = More money staying in your pocket

- Better job opportunities = Many employers check credit for financial positions

Think about it: If fixing your credit saves you $200 per month in interest and fees, that’s $2,400 per year. Invested at 8% annual returns, that becomes $65,000 over 20 years. All from one quick credit fix.

The Wealth-Building Connection

Here’s what most financial advisors won’t tell you: credit isn’t just about borrowing money, it’s about accessing leverage to build wealth faster. Wealthy people use good credit to:

- Buy rental properties with minimal down payments

- Secure business loans to scale operations

- Get premium credit cards with cash-back rewards

- Access investment credit lines for strategic opportunities

When your credit is excellent (750+), banks compete for your business. When it’s poor (below 650), you’re lucky if anyone will work with you at all.

Start Tonight

Don’t wait until Monday. Don’t wait for your next paycheck. Log into your credit card accounts right now and see your utilization ratios. If any card is over 30% utilized, make the largest payment you can afford tonight.

Call your credit card companies tomorrow and ask for limit increases on every card. The worst they can say is no, but many will approve increases that instantly improve your utilization ratios.

Set up autopay for minimum payments on every bill. This takes five minutes per account but protects you from ever missing a payment again.

Your future wealthy self is watching what you do right now. Don’t let a bad credit report be the reason you never build real wealth.

Ready to Turn Your Credit Into a Wealth-Building Tool?

Fixing your credit is just the first step. The real magic happens when you combine good credit with a proven wealth-building strategy that works for regular people.

If you’re serious about using credit as a tool to build generational wealth, join our exclusive wealth-building membership at www.mwrfinancial.com/krnrstn21. You’ll get the exact blueprints wealthy people use to leverage good credit into multiple income streams and long-term wealth.

Don’t let another month go by paying the “poor credit tax.” Your wealth depends on the move you make right now.

Tweet Draft for Sonny: “Your credit report might be the silent killer destroying your wealth 💀 One quick move can boost your score 50-100 points in 30 days. Here’s exactly how to do it ⬇️ #CreditRepair #WealthBuilding #FinancialFreedom”

Note to Sonny: Please post this tweet when the blog goes live and tag relevant finance hashtags for maximum reach.

Leave a comment